Launching an investment fund takes a great deal of proverbial elbow grease. It requires buy-in and participation across an organization. It is also fraught with risk, as investment success is hardly assured and the likelihood of reaching an economically viable scale is relatively low. Launching an investment fund is optimism writ large.

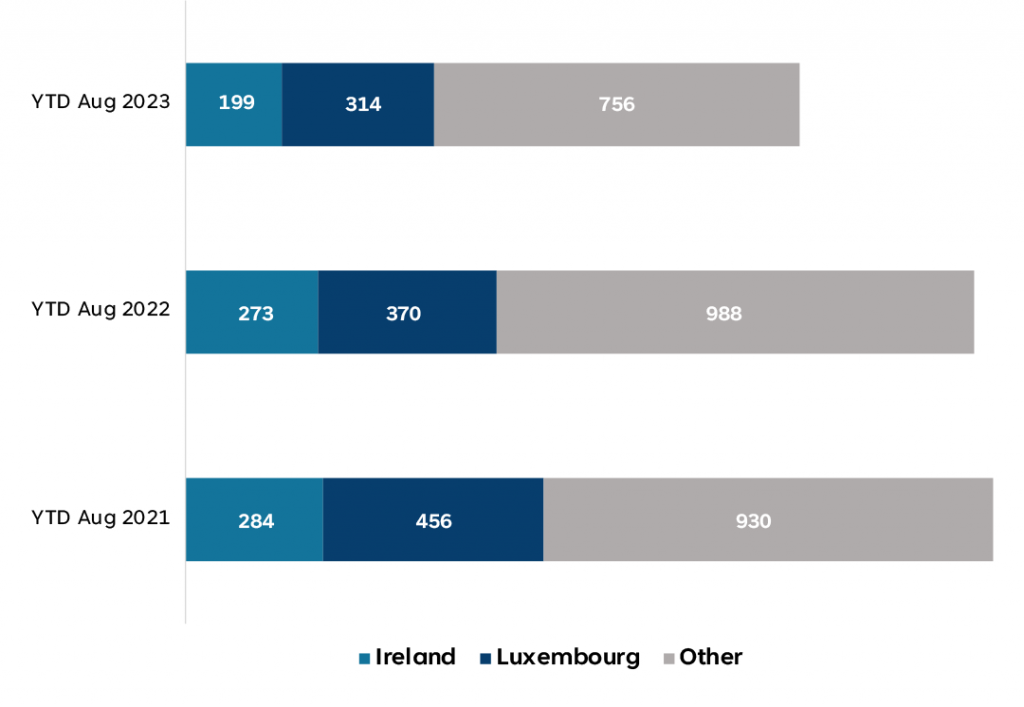

The heady days of the pandemic, where equity returns shot for the moon and savings accounts swelled are over. Inflation and an accompanied rise in interest rates have flipped the economic and household finance script to a more pessimistic tone. It is not entirely shocking then, that the pace of European-domiciled fund launches has slowed considerably in 2023. Year-to-date (YTD) August 2023 figures have European-domiciled fund launches at 77% of the YTD August 2021 and 2022 average. This decline is not particularly regionally sensitive within Europe, with the cross-border markets seeing declines of a similar magnitude to the total.

Figure 1: Caution is the word of the day as fund launch activity slows

Number of long-term European-domiciled funds launched by domicile

Note: Data excludes money market funds.

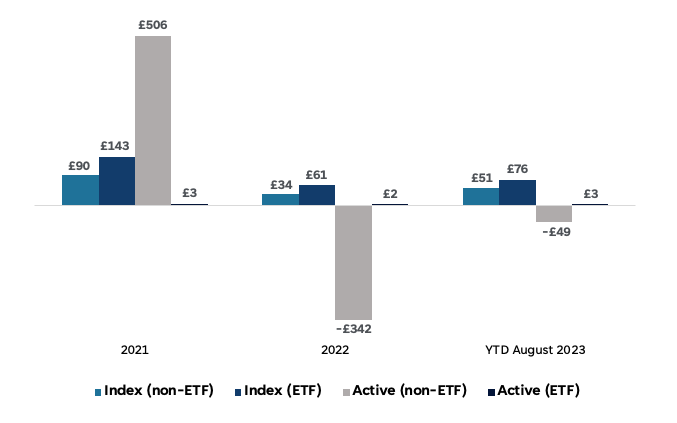

As the economic clouds gathered and performance of both equities and bonds turned negative in 2022, so, too, did net sales of investment funds across Europe. Whereas many of 2021 and 2022’s fund launches would have been planned and initiated during periods of positive net sales, the last 14 of 18 months have seen net sales fail to cross the 0.1% of beginning AUM mark, with 12 of those months registering net outflows. Similarly, the year 2022 saw performance turn negative across the asset class spectrum. For many fund managers then, asset bases and their associated revenue streams have been hit doubly hard. The impact of this contraction is thus likely leading many managers to reduce their budget allocation and risk appetite when it comes to fund launches.

Figure 2: Flows steady in 2023 but few signs of 2022’s outflows being reinvested

Long-term European-domiciled investment fund net sales in billions

Note: Data excludes money market funds and fund of funds.

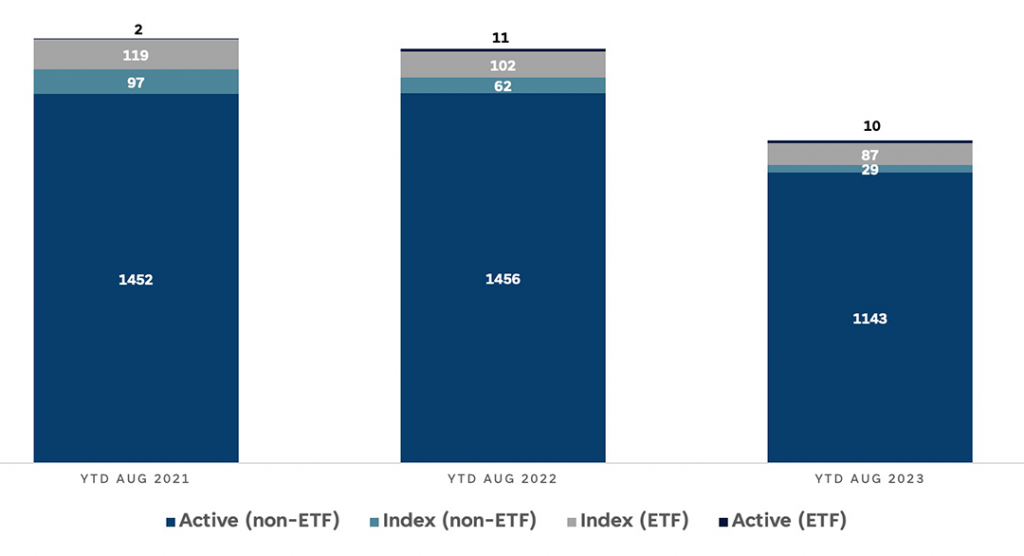

While active funds have suffered by far the greatest losses from a net sales perspective since 2022, netting -€385 billion in sales, fund launches were still primarily focused here. The active space remains attractive for a myriad of reasons, including the ability to charge higher fees, thus driving more revenue from fewer assets, a less concentrated competitive marketplace and a large existing customer base from which to try to win mandates. On the latter two points, it is worth noting that as of August 2023, active fund assets accounted for nearly 75% of European-domiciled fund assets, with the largest 10 managers accounting for just 23% of total assets. The equivalent manager concentration level for index funds is 76%.

Figure 3: Launch sequence activ(e)ated

European-domiciled fund launches by active, index and product chassis

Note: Data excludes money market funds.

The index fund business largely remains a winner takes all business where one is challenged to either create a new sub-strategy within the business—think thematics—or perhaps win in a race to the bottom on pricing to gain and maintain market share. Building an economically meaningful index business is therefore a significant challenge. With fewer managers operating in the space and a potentially more limited opportunity set, the index business has yet to witness a take-off in launches.

Within the index business, there has been a notable shift in fund launches toward ETF and away from non-ETF product chasses. Non-ETF index fund launches have dramatically fallen off in 2023 after declining in 2022 even as ETF and non-ETF product chasses are similar in assets under management (AUM) and both experienced positive flows in 2022 and 2023. Index ETF net sales totalled €137 billion over the period compared to €84 billion for non-ETF Index investment funds.

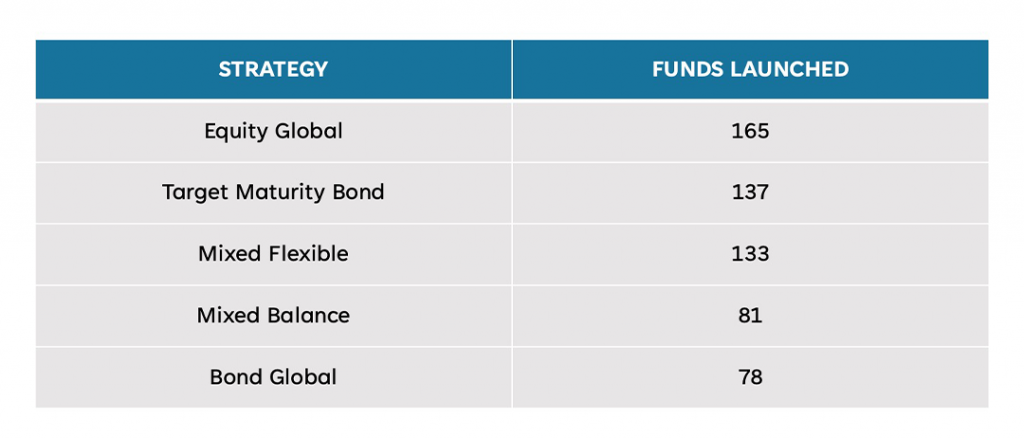

While equity funds continue to lead product launches, the gap is narrowing. Year-to-date 2021, equity launches accounted for 41% of all launches—a figure that sits at 30% for 2023.

Figure 4: Looking beyond equities

European-domiciled equity funds as share of total fund launches

Note: Data excludes money market funds.

Similarly, equity global funds though remaining atop the strategy rankings, with 165 launches, no longer lead by a wide margin. Trailing close behind are target maturity bond funds at 137. The target maturity bond strategy has in fact seen over 200 launches in the trailing 12 months to August 2023. They are also the sole reason that bond funds have registered an increased launch count in 2023. Highlighting the strategy’s newfound popularity is that 42 of the funds debuted are domiciled in Ireland and Luxembourg, potentially indicating that fund managers are expecting broad interest amongst European investors. Flows to date, however, have been largely concentrated amongst Spanish-domiciled funds, and so whether this broader European interest materializes remains to be seen.

Figure 5: Leading European-domiciled fund strategies in 2023

Investor attention beyond equities, however, is much more diverse than target maturity bond strategies and also incorporates other bond strategies, alternatives and mixed asset funds. Excluding target maturity funds, bond, alternatives and mixed asset funds have all seen an increase in share of launches by 2-3% compared to 2021 and 2022. While no single fund type has seen a surge in launch activity, the decline in the prevalence of equity fund launches does open a much wider debate. Will the next decade see a resurgence and tilting of portfolios in favour of non-equity funds? Certainly, the conversations around alternatives are already hot. Will this amount to increasing net sales for liquid alternatives? And can bond funds, which have yet to capitalize on higher rates—with many investors likely sitting in deposits and potentially rueful over bond fund losses in 2022—redirect the investment narrative in their favour?

Looking to the future of investment fund product development in Europe, one is left with more questions than answers. Amid such a cloudy economic picture, there is no definitive answer as to what to launch next. Though ETFs and indexing will be central to the story, will they act as a driver of innovation, consolidation or both? And what of the future of active funds? Has their heyday passed, or are today’s outflows a call to action for fund managers to evolve their strategies, including their delivery? Are active ETFs calling?

As always, only time will tell. Time, however, may not be a luxury that all fund managers enjoy. Funds of an age over 15 years have lost a whopping €472 billion since 2020 through net outflows, with not even 2021 seeing positive net sales for these funds. Launching new products may therefore not merely be a practice in optimism, but also a question of long-term survival.

“It is only the farmer who faithfully plants seeds in the Spring, who reaps a harvest in Autumn.” — B.C. Forbes

Talk to us today to learn more about how ISS Market Intelligence can help your business plant the optimal seeds.

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence.