For newly launched investment funds, achieving scale is paramount to long-term success, as the benefits of scale can lead to additional sales momentum for a fund. Scale often comes with the following key advantages:

- Enhanced credibility with investors and gatekeepers

- Ability to attract larger investors, often restricted from owning an outsized share of a fund and/or have liquidity requirements

- Economies of scale, both related to the fund’s operational costs and portfolio management activities

While scale is a relative term dependent on the investment strategy, fund vehicle and charges, a fund breaching the $100 million assets under management (AUM) mark is generally deemed to be a success. Fund managers may therefore want to consider the chances of a given strategy hitting this mark, or hitting their defined success mark, as part of their product development process.

Our new fund analytics data points available on ISS Market Intelligence’s Simfund platform can shed light on this. Simfund has recently included new data points that track the number of months it took for a fund to reach $100 million, $300 million $500 million, $1 billion and $5 billion in AUM.

Using Simfund’s newly-minted dataset reveals that just 25% of European-domiciled funds launched between 2010 and September 2023 achieved the magic $100 million-AUM figure by their first birthday.

Figure 1: Off to the races

Percentage of long-term European domiciled funds launched between 2010-2023 reaching $100 million in AUM within 12 months of launch

Passive funds, which have seen their assets grow by a factor of 3.5 over the last decade, have unsurprisingly hit the mark at a higher rate than active funds, with a third of the funds achieving the mark in the first 12 months. However, with most passive funds charging a lower asset management fee compared to their active peers, it is worth considering whether the $100 million mark is as useful a benchmark for passives as for actives. From this perspective, it is worth noting that a mere 15% of passive funds crossed the $300 million threshold by their first birthday.

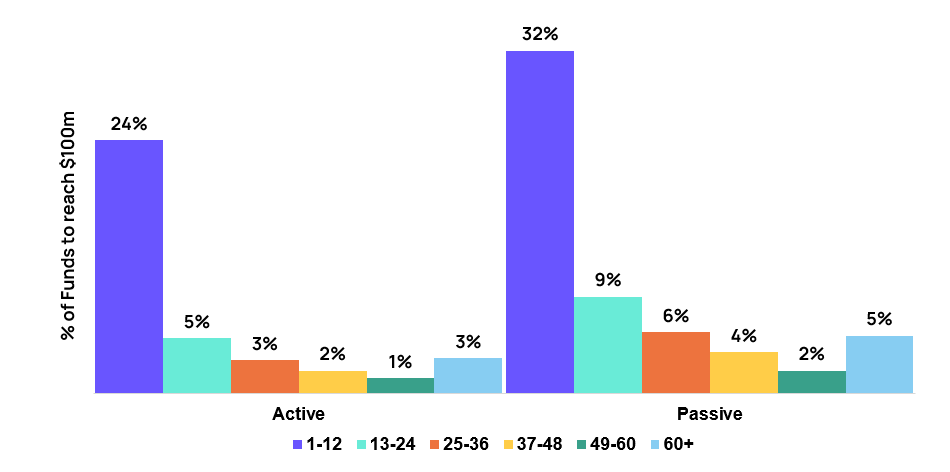

Figure 2: No time like today

Percentage of long-term European domiciled funds launched between 2010-2023 reaching $100 million in AUM by months from launch

For both active and passive funds, as shown in the chart above, the first year is the most important year for attracting assets. After year one, the odds start to drop significantly. This is particularly true for active funds, where only around 15% of funds launched since 2010 have reached the mark from year two onward. For passive funds, another 26% will reach the magic number in year two and beyond. For both active and passive managers, this brings attention to the importance of timing when it comes to the success of funds-gathering assets. With no significant bump seen in the odds of a fund hitting $100 million in AUM in years three to five, when a fund boasts the requisite performance history to be recommended by many gatekeepers, it appears many funds will be on a path to success or failure well before it has established anything close to an indicative performance history. With the fund gestation process often taking six months or more, fund managers may want to consider whether their launch process incorporates taking the temperature of the investment market before a launch is finalised. The pain of working toward a launch and then having to hold off might just be less than seeing a fund fail to overcome a deck stacked against it.

The above analysis builds on a previously published insight (https://insights.issgovernance.com/posts/the-100-million-fund-challenge/) adding further weight to the argument that funds need to come hot out of the gate. The momentum built up in the first few years of a fund’s life might well carry the fund to future success or at least limit the chances of it failing to reach scale. With performance unlikely to be the dial-mover for a fund’s AUM gathering efforts in the early years, the heavy lifting will likely rest on sales and marketing teams—and on triangulating investor and advisor appetites in terms of investment strategy and product features. These findings also hint that the true value of having a large seed investor may extend well beyond the short-term impact on the bottom line, and thus justifies the discounts often provided to attract such investors.

For most funds, the value to investors will be in their long-term investment performance. Most funds, however, will never enjoy a fair chance to deliver on this promise.

Talk to us today to learn more about how ISS Market Intelligence can enhance your product development process and increase your chances for early success.

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence

Jinesh Shah, Vice President, Client Success, EMEA ISS Market Intelligence