Building a brand is more akin to chiseling stone than molding clay. Brand perception is profoundly influenced by factors outside of marketing’s control—investment performance triumphs and setbacks, portfolio manager turnover, mergers and acquisitions, and product innovation are some of the many factors that shape a brand. Brand reputations aren’t stationary. The longer a manager’s investment performance lags the competition, the deeper it chips away at a brand.

Brand management is an ongoing and iterative process at asset managers. Understanding shifts in advisor sentiment tied to the numerous factors that shape their brand perception, both broadly and for individual brands, is indispensable to cultivating a robust brand. The top five brands identified by advisors as “best-in-class” are American Funds, Vanguard, BlackRock, JPMorgan, and First Trust.

The April 2023 ISS MI Market Metrics Brand Perception and Podcasts study, part of the ongoing Selling Retail Investment Products through Intermediaries research, measured the value that advisors place on asset managers’ brands, the attributes and activities that impact brand perception, and advisor rankings of asset manager brands based on both best-in-class and trust. This year’s study also examined advisors’ attitudes towards multi-manager brands and podcasts.

Most advisors (86%) believe a strong brand is an important asset when recommending asset managers to clients, with even more wirehouse advisors placing value on a strong brand. Nearly one-quarter of overall advisors (23%) assign extreme importance to a strong brand. One advisor we surveyed conveyed the importance of a strong brand in working with clients relating that “quality names are usually recognizable by clients and prospects, making my job easier.”

A quarter of all advisors believe American Fund’s brand is best-in-class, but other firms are recognized for their strengths

Trust, performance, and ease of business are the most critical brand-defining factors

When people think of branding, the first things that come to mind are often the marketing-directed tactics tied to branding—crafting a firm’s logo and tagline, its color palette, and selecting advertising placement. These endeavors are beneficial, but it is the totality of an advisor’s experience with an asset manager that forms their perception of a brand.

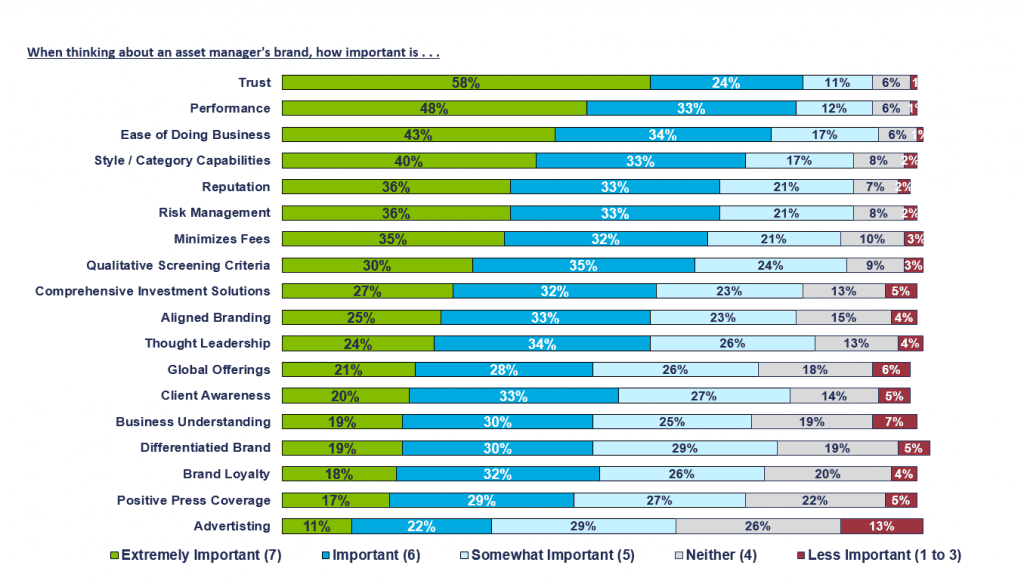

Advisors rate trust, performance, and the ease of business as the three most critical factors in defining an asset manager’s brand. It is notable that trust, which 58% consider extremely important, outranks performance, which 48% rate as extremely important, in defining a manager’s brand. Notable differences appear across channels. Compared to wirehouse advisors and RIAs, independent, regional, and bank channel advisors place even more importance on trust with 63% considering it extremely important.

Notably, an asset manager’s position in the industry (e.g., being the biggest or cheapest) doesn’t automatically earn it the top ranking based on trust. Our study revealed that the four most trusted brands in 2023 are American Funds, JPMorgan, MFS, and First Eagle.

RIAs’ attitudes often diverge from other channels. True to form, RIAs have a unique perspective on the most critical factors that define an asset manager’s brand. Fewer RIAs (52% vs. 58% of overall advisors) deemed trust to be extremely important. Minimizing fees jumps to second place among RIAs, with more than half (52%) of RIAs considering low fees to be extremely important (the same factor was ranked seventh in importance among all advisors.) Ease of business is somewhat less imperative to RIAs; this factor drops to fourth place, replaced by style/categories as a top three factor which is rated extremely important by 39% of RIAs.

Advisors rate trust, performance, and ease of business as the three most critical factors in defining an asset manager’s brand

Trust is the foundation of client relationships. Unsurprisingly, performance is the top driver of trust, with most advisors (61%) ranking it among the top three factors that build trust. When recommending a product to a client, an advisors’ reputation is at stake, and trust underpins their decision. Putting investor’s needs first, demonstrating superior capabilities in specific investment styles/categories, and risk management topped the list of factors that cultivate trust.

The Benefits and Perils of Multi-Brand Marketing

Relatively few brands are commonly known, highly regarded, and differentiated. Managers with a stable of sub-brands face unique considerations about how much to illuminate the core brand while not diluting its positioning by shining too much light on their affiliate or subadvisor brands. Our research revealed that most advisors (58%) don’t think employing sub-advisors or having a multi-affiliate approach impacts a firm’s brand, but a meaningful share of them (42%) have either a positive or negative impression.

Operating a multi-manager approach poses positioning opportunities and challenges beyond juggling the brand name prominence of affiliates or subadvisors. The asset management landscape is cluttered with brands—and a multi-manager’s access to best-in-breed managers is a differentiator. About one-quarter of advisors (26%) believe that a multi-manager approach impacts a brand positively. When asked how they think employing sub-advisors or having a multi-affiliate strategy impacts an asset manager’s brand, advisors cited the benefits of unique expertise and access to specialists.

There is also a small group of critics to multi-manager approaches; 16% of advisors believe the multi-affiliate approach impacts a firm’s brand negatively. One surveyed advisor voiced the concern “that using sub-advisors is an extra level of complexity and fees. Just another mouth to feed from my client’s assets.”

Increasingly, we’ve observed managers-of-managers downplaying their affiliate and subadvisor brands, instead coalescing brand messaging around asset class expertise under the umbrella of their core brand.

Brand Influencers

Marketers manage their firm’s brands amidst persistent economic, capital market, and industry changes. The intermediary distribution landscape itself has transformed over the past decade as advisors’ value has shifted away from portfolio construction towards holistic planning, channel distinctions have at once blurred and recalibrated, and advisor teams have proliferated. Meanwhile broker dealers have limited platform access and the costs of “shelf space” have risen. Notwithstanding these myriad changes, wholesalers remain vital brand emissaries in the intermediary channels.

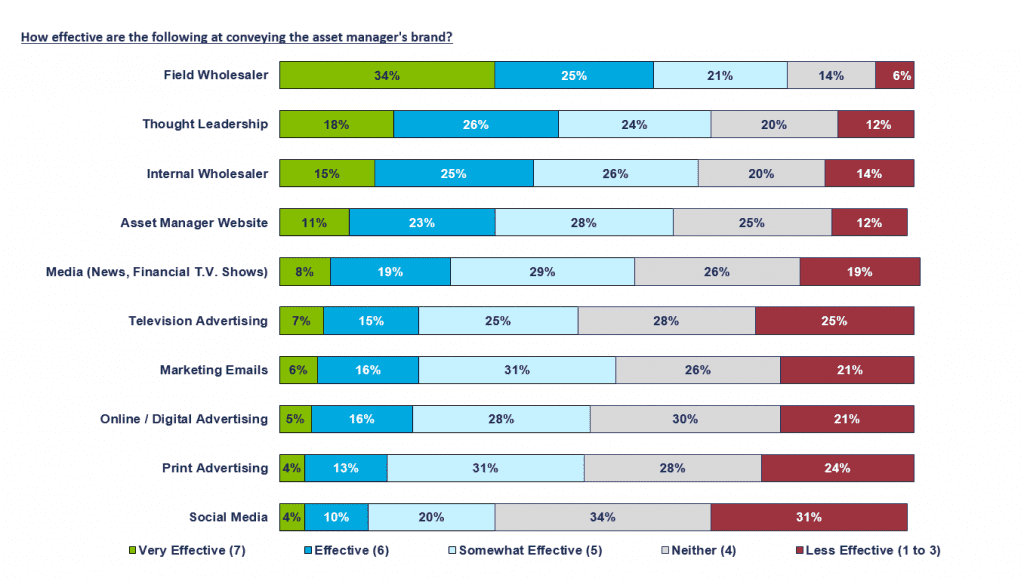

When asked which of ten influencers, ranging from sales professionals to content to media, are most effective at conveying an asset manager’s brand, field wholesalers topped the list. Fully 80% of advisors ranked the field wholesaler as effective at conveying an asset manager’s brand, and 34% tagged them as very effective. Thought leadership ranked second, followed by internal wholesalers. There are differences across channels, with RIAs tending to put more credence in a firm’s thought leadership.

Media (e.g., news, financial shows), television/digital/print advertising, marketing emails, and social media are deemed very effective by a noticeably smaller group of advisors. Moreover, a larger cohort of advisors deemed these approaches to conveying brand to be less effective. For example, 25% of advisors rate television to be a less effective approach, as do 24% of advisors for print advertising, while just 6% consider field wholesalers to be less effective. These findings might prompt some industry professionals to question the value of costly advertising and other branding activities. Yet while fewer advisors rated advertising as effective as some of the other branding tools, nearly half of advisors recognized that television, digital, and print advertising can be effective.

Advisors generally believe that the field wholesaler is the most effective at conveying an asset manager’s brand

The power of non-human interfaces (e.g., websites, advertising) is their ability to lift brand awareness— at scale—among thousands of advisors and other clients and prospects. Most wholesalers can only sustain a relationship with about 200-400 advisors, often referred to as their tier-one advisors. While internals and hybrids can boost the number of advisors that the sales team can interface with on a regular basis (i.e., their tier-two advisors), time constraints pose natural limits.

Among the salesforce-connected cohort of advisors, the customer journey might begin with a meeting with field sales or a call with an internal wholesaler or specialist. A manager’s website, content, and media exposure reinforce the brand message, helping to sustain brand loyalty and advancing the advisor along the client journey. More than half (56%) of advisors acknowledged earned media’s (news, financial TV shows) effectiveness at conveying brand.

Maximizing brand exposure among a wider circle of advisors (sometimes dubbed tier-three advisors) and their clients depends on proactive marketing activities including pushing out thought leadership, advertising, public relations. These and other scalable tactics can launch an advisor journey.

Nearly 70% of advisors find value in thought leadership, with the RIA channel prizing it most as previously mentioned. Advisors consume thought leadership in various forms (e.g., white papers, podcasts). The economic and capital-markets centric thought leadership that asset managers generate provides advisors with valuable insights to weave into their client conservations

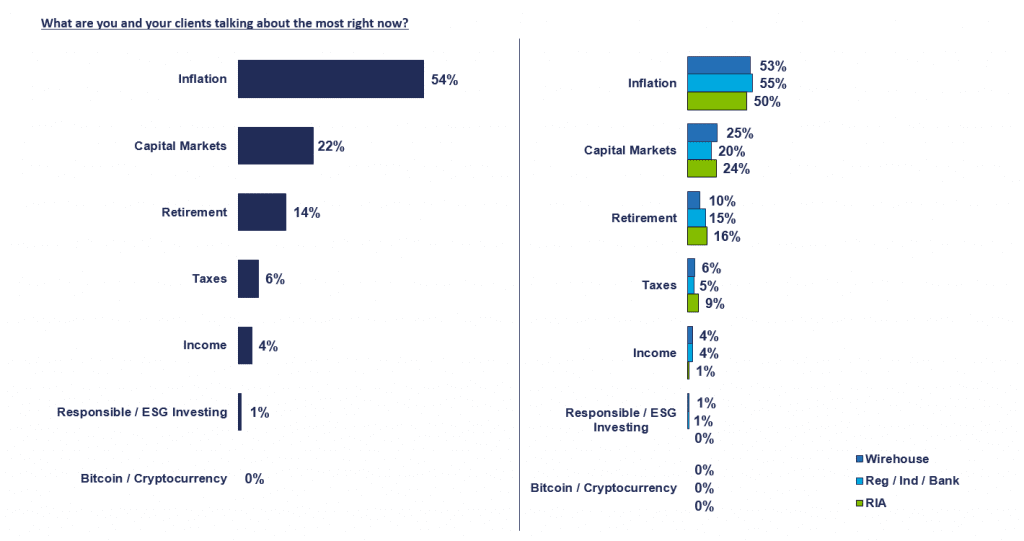

There is no shortage of topics for advisors to discuss with clients at present. More than half of advisors (54%) stated the inflation was the topic coming up most frequently in discussions with clients. Fewer advisors (22%) are currently focusing client conversations on capital markets. Given the industry buzz around direct indexing and the benefits of tax loss harvesting, one might expect that taxes would rank much higher, yet only 6% of advisors are talking with clients about taxes more than other subjects.

What Advisors are Talking About with their Clients

Branding is a Collaborative Act

It bears repeating that it is the totality of an advisor’s experience with an asset manager that shapes their perception of the brand. The confluence of factors that shape brand perception are at once interdependent and independent. Geopolitical and economic uncertainty continue to test both asset managers and advisors to be able to respond quickly to market volatility, most recently in the wake of Silicon Valley Bank and subsequent bank failures. Helping advisors navigate market events requires a team effort among marketing, portfolio managers, product managers, and sales professionals.

Advisors across all channels assigned trust as the most important factor defining a manager’s brand. Over time, firms build trust among clients with reasonable fees, consistent investment performance, and the absence of corporate wrongdoing. Many asset managers prioritize innovation, yet flavor-of-the-day product development can dent trust. As one advisor we surveyed put it “When the offering is from a well-respected, well-known, well-thought of company, it tends to ease their suspicions that they are being sold something.”

Ease of Business as a Differentiator

Demands on advisors’ time are growing, so it is not surprising that they value the ease of doing business with managers. It is remarkable, however, that ease of doing business garnered higher rankings than the numerous other factors that shape brand perception including risk management and minimizing fees which are fundamental product benefits. Stellar client service and support is a quality where asset managers can differentiate their brand.

Day-to-day trust is nurtured by understanding and respecting advisors needs with timely and accessible content, a consultative sales approach, and client-centered service. When evaluating asset managers, advisors prioritize top-notch support. The Market Metrics year-end 2022 Advisor Satisfaction study revealed that inbound telephone support ranked as the second most important factor in evaluating asset managers, with 45% of advisors considering it extremely important and surpassed only by investment performance which was cited by 52% of advisors.

An interesting finding from this research is that the factors that most shape an advisor’s brand perception dovetail with their assessment of best-in-class. Advisors naming First Trust as the best-in-class brand, for example, place higher importance on ease of doing business, risk management, and business understanding, while advisors naming American Funds as best-in-class place higher importance on trust and thought leadership.

Podcasts

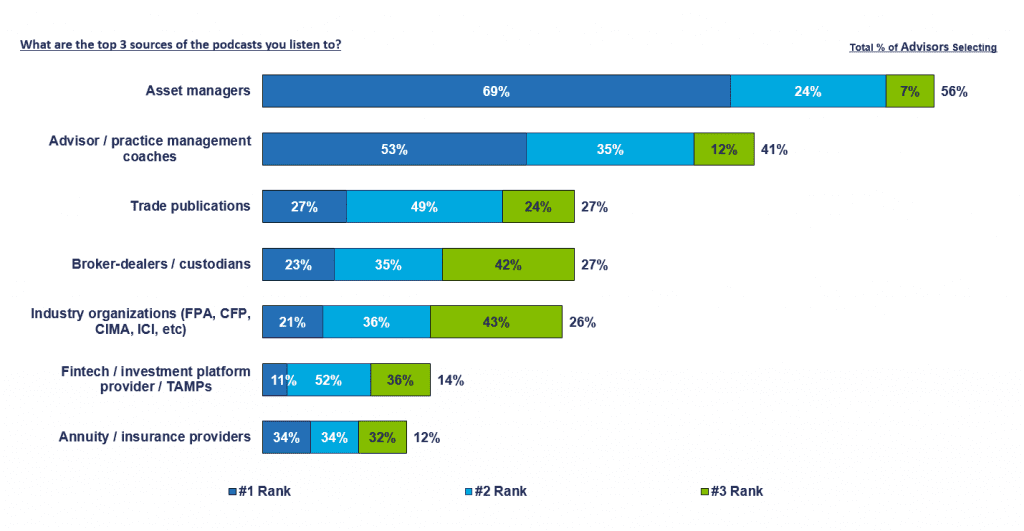

To capture and sustain advisors’ attention, asset managers must craft the right message, at the right time, to the right audience, and deliver it through the right medium. One of those communication mediums is podcasts. Nearly 40% of advisors listen to podcasts, a relatively high percentage in this era of fractured attention. When asked which asset managers have the best podcasts, advisors selected American Funds, JPMorgan, and Blackrock as the top three providers.

Understanding how various advisor segments prefer to consume thought leadership and other content is fundamental to facilitating ease of doing business and driving engagement. Younger advisors (i.e., those under 40) and RIAs exhibit higher use of podcasts than older advisors and other channels.

Asset managers are advisors’ preferred source for financial podcasts, ranked first by nearly 70% of advisors. Advisor/practice management coaches and other podcasts producers also vie for advisor mindshare demanding that asset managers’ content is timely and digestible. More than half of advisors ranked market and economic trends as their top area of interest, and 40% of advisors rate portfolio construction as their topmost interest.

Asset Managers are advisor’s preferred source for podcasts

This brand study leaves us with multiple key implications and further thoughts, including:

- The main brand attributes that asset managers convey through their taglines, advertising, websites, and other means tend to center on investment qualities (e.g., fundamental research, impact investors, global investment analyst team) and trust. Many of these phrases are frequently used and not sufficiently differentiating. Recently, managers have made meaningful strides in crafting differentiated language to distinguish their brands, but more progress is needed.

- With ease of business serving as one of the three most critical factors in defining an asset manager’s brand, marketers should seek out opportunities to underscore a firm’s client-centered approach. Every interaction with an advisor is an opportunity to reinforce, or accidentally undermine, a firm’s commitment to being easy to do business with. Overwhelming an advisor with too many emails (particularly generic ones), for example, may annoy them and detract from the brand. Data-driven segmentation and marketing can contribute meaningfully to optimizing the service model.

- The role of marketing has evolved from sales support to distribution partner. Crafting timely, thoughtful, and differentiated thought leadership requires that managers allocate adequate resources in marketing to recurrently research, write, and publish new content. It is critical that senior sales and marketing management work in partnership to balance the appropriate allotment of resources across both organizations. This collaboration is particularly challenging—yet even more imperative—with budgets under pressure and the need for resources to build out specialist teams (e.g., ETF and alternative specialists).

- When done effectively, delivering thought leadership and other content via podcasts is one of many tactics that can facilitate ease of doing business with a manager, which our study found is one of the three most critical factors shaping brand perception. Maintain a predictable, weekly schedule for releasing podcasts, keeping each podcast under 30 minutes. Make them easy to access by distributing your firm’s podcasts through both your website and the Apple and Spotify podcast apps.

To learn more about ISS MI’s offering, visit Market Metrics Advisory Research at https://www.issgovernance.com/market-intelligence/market-metrics-advisory-research/

Authored by:

Cindy Zarker, Associate Director ISS Market Intelligence