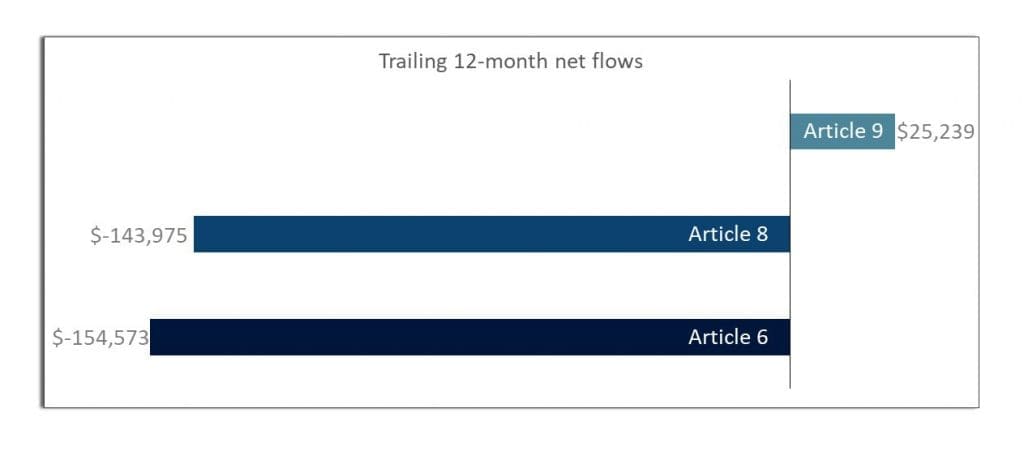

Breaking news: Article 8 investment funds do not defy the laws of fund physics. When markets head south, so, too, will Article 8 fund flows. Article 8 funds experienced significantly negative flows in 2022, nearly as much as Article 6 funds; Article 8 funds may just be too big not to fail.

Figure 1: Trailing 12-month net flows by SFDR article (in millions)

Article 8 to the fore

Since the ink dried on the Sustainable Financial Disclosure Regulation (SFDR) in 2019, investment funds classified as Article 8 have collected over $4 trillion in assets across 8,500 funds. A figure that highlights how ‘core’ Article 8 funds have become to many investors. The wave of money moving to Article 8 funds has been driven both by the conversion of existing funds and the launch of new funds. Of our Simfund Global dataset, a mere 18.5% of funds and 6.4%[1] of assets are accounted for by funds launched since 2020. The majority of growth in Article 8 funds has been tied to pre-existing funds attaining that status.

Figure 2: Sizing the Article 8 Marketplace

Given this, it is natural to wonder whether the wave of activity related to Article 8 funds has potentially crested. As environmentally-, socially- and governance- (hungry)minded investors likely already find their assets in Article 8 or higher funds, Article 8 and 9 adoption rates among investors may slow. Fund managers may increasingly want to ask themselves whether their limited distribution budget would be better spent converting the uninitiated or persuading the already converted to move more of their money. For those choosing the latter, differentiation will be essential. As demonstrated above, the Article 8 arena is brimming with competition. Luckily, not all ESG funds, including Article 8 funds, are made equal—a fact our research has previously highlighted[2].

Names matter

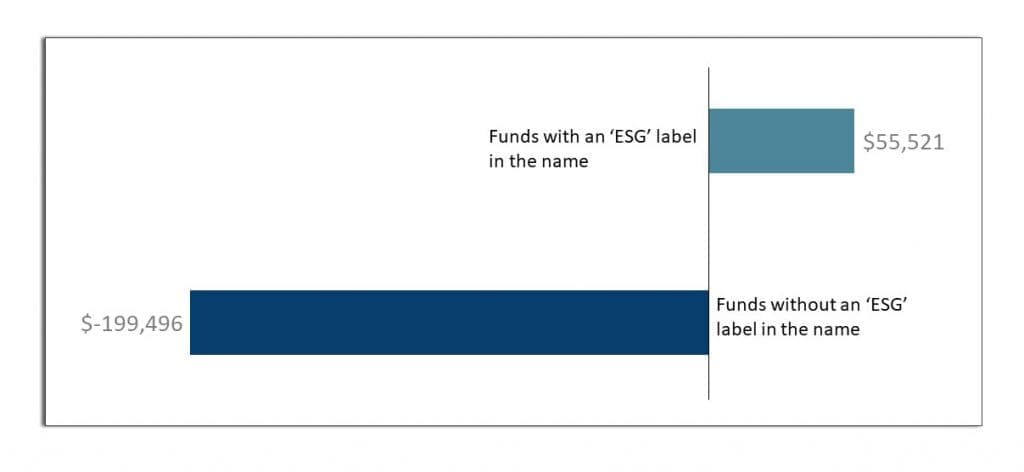

An ESG fund does not have to have an ESG label in the name; the way a fund is marketed does not change what is under its hood, but it does signal the intentions of the fund and fund manager. In 2022, Article 8 funds with an ESG label in the name sold comparatively better. In fact, compared to Article 8 funds without an ESG label, the gap is downright cavernous. This has been covered previously in our research and remains an idea that fund managers may wish to explore further. If investors are using naming as a key filtering tool, consciously or sub-consciously, then $3.3 trillion in assets—those un-labelled—appear to be at risk. Could that potential risk be minimised with a name change? Not surprisingly, the vast majority of these assets sit in funds with vintages of 2018 or earlier. Name changes are not without effort, nor are they free of costs. Indeed, the costs of renaming a fund, particularly a widely held one, are well understood. But are the costs of leaving a fund stuck with a name past its due date equally well understood?

Any rush to rename funds, however, will face regulatory hurdles. The naming conundrum and the question of how meaningful names are has not gone unnoticed by regulators. The European Securities Markets Agency (ESMA) and Financial Conduct Authority in the United Kingdom have proposed to address this.

Figure 3: Trailing 12-months net flows for Article 8 funds (in millions)

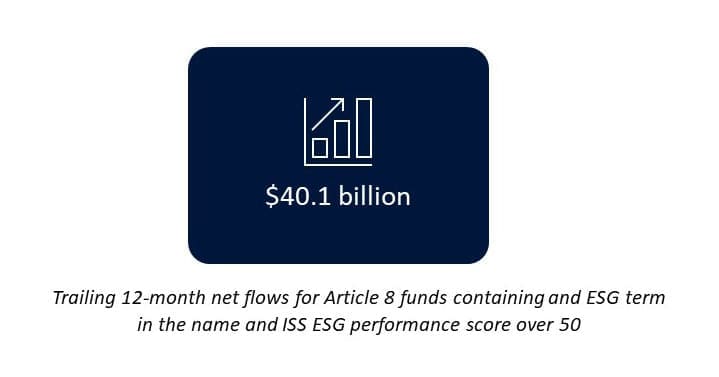

50 shades of green

A label may of course only be as deep as the paper it is written on. A better bellwether of ESG funds may be the ESG metrics of their portfolios. Layer on ISS ESG’s fund performance score and it becomes apparent that funds with an ISS ESG performance score over 50, which puts them in “Prime” status territory, had the sales advantage over the past 12 months. Article 8 funds containing as ESG label and an ISS ESG performance score of over 50 attracted $40.1 billion in net flows. Meanwhile, Article 8 funds with a performance score of over 50 but without an ESG label lost $27 billion in flows. While not spectacular, it is still far better than the over $170 billion lost in flows by Article 8 funds without an ESG label and either without an ESG score or a score of under 50.

The $3.7 trillion opportunity

While SFDR was not meant as a labeling regime, it essentially became one. And Article 8 defined the line between the ESG fund haves and have-nots. In doing so, SFDR generated a wave of activity, fund launches and fund changes, as fund managers aligned their fund shelves to fit this paradigm. Article 8, the lighter “green” of the articles, quickly became a hotbed of activity and almost overnight became a crowded space. In some ways, the rush to graze the Article 8 pastures by fund managers may in fact have led to a classic “tragedy of the commons.” The urge to claim one’s share of the spoils may have ultimately deteriorated the quality of the commons. Article 8 funds, of low- and high-quality ESG strategies competed on equal grounds, at least until investors built their own ESG heuristics. European regulators have naturally started to fence the Article 8 commons, clarifying the minimum criteria for Article 8 funds. Nonetheless, to this today, it remains a crowded and heterogeneous common. The overhanging question then remains, how does one differentiate their Article 8 funds?

Answering this question might just allow fund managers to capitalize on a $3.7 trillion opportunity. Based on where positive Article 8 flows landed in 2022, flows appear correlated with funds posting high ESG scores and containing a signifier in the name. $3.7 trillion in Article 8 assets sat outside this definition and could be at risk. While the connection between naming and flows requires further investigation, it held fast throughout 2022. Certainly, this is where our attention will turn next, namely to answer Shakespeare’s age-old question, “What’s in a name?”

Talk to us today to learn more about how ISS Market Intelligence can help your business.

Notes:

[1] Based on the launch date of designated primary share class.

[2] https://insights.issgovernance.com/posts/act-2-we-know-what-esg-demand-was-but-not-what-it-may-be/

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader ISS Market Intelligence