ISS Market Intelligence Projects U.S. AUM to Hit $43.6 trillion by 2029 Amid Surge in Active Strategies and Liquid Alternatives

Our research underscores a pivotal transformation in the investment landscape. The convergence of increased market complexity and investor sophistication is driving the shift toward active strategies and liquid alternatives.

Have we hit the peak of the model portfolio adoption curve?

The model portfolio sector in the U.K. is at a crossroads. Following a sales boom in 2023, model portfolio (MPS) gross sales growth in the financial adviser channel in the U.K. slowed to just 6% during the first half of this year. This has left many people wondering: have we reached the peak of the […]

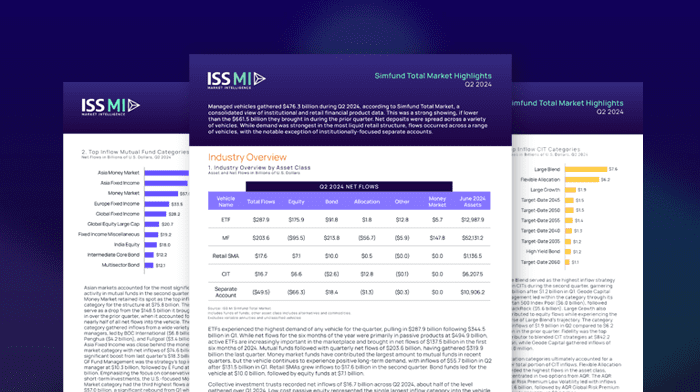

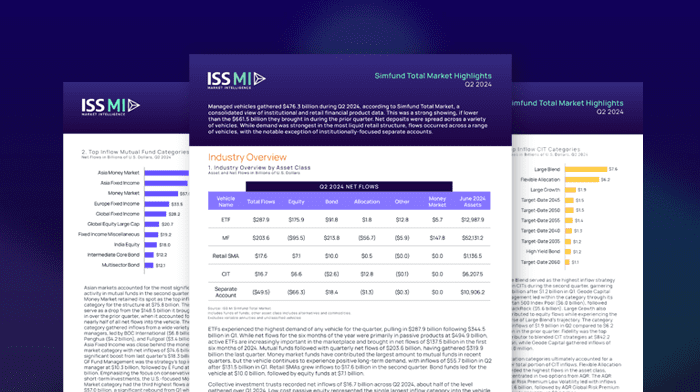

Simfund Total Market Highlights Q2 2024

Managed vehicles gathered $476.3 billion during Q2 2024, according to Simfund Total Market, a consolidated view of institutional and retail financial product data.

Multi-Asset Fund Sales Turn Positive for the First Time in Five Quarters

Net sales of multi-asset funds, in the U.K. turned positive for the first time in five quarters in Q2 reaching £0.5 billion, according to new data from ISS Market Intelligence (ISS MI).

New Research Highlights the Crucial Role that Digital Content Plays in Financial Advisor Decision Making

Thought leadership content is a critical way for asset managers to promote their investment philosophy, display how their products respond to market conditions, and win over advisors.

ISS MI’s Advisor Pulse Research Reveals Digital Content’s Role in Investment Decision Making

The Advisor Pulse Series – Digital Content report is based on the results of over 600 interviews with U.S.-based financial advisors in September 2024.

Model Portfolios Sell Out of UK Equities as Providers Go in Search of Gains

UK Model portfolio providers (MPPs) reduced their exposure to UK equities in the second quarter despite hiking their overall allocation to equities in a bid to boost returns, new data from ISS Market Intelligence reveals.

Direct Indexing Opens Opportunities for Advisors to Pursue High-Net-Worth Clients

Direct indexing likely resonates with wirehouse advisors because it is an approach designed for ultra-high-net-worth clients that are most frequently found in the channel.

Model portfolio sales slowed in first half of 2024, finds new ISS MI research

Model portfolio sales grew just 6% over the course of H1 2024 both in aggregate and amongst individual firms using model portfolios, down from 13% in the same period a year earlier. Channel gross sales meanwhile grew by 14%.

Interest in Active ETFs Is Growing, but Passive ETFs Continue to Dominate Advisor Preferences

While passive ETFs have been the largest driver of the activity, and account for more than 90% of ETF assets, interest in active ETFs has also grown steadily.