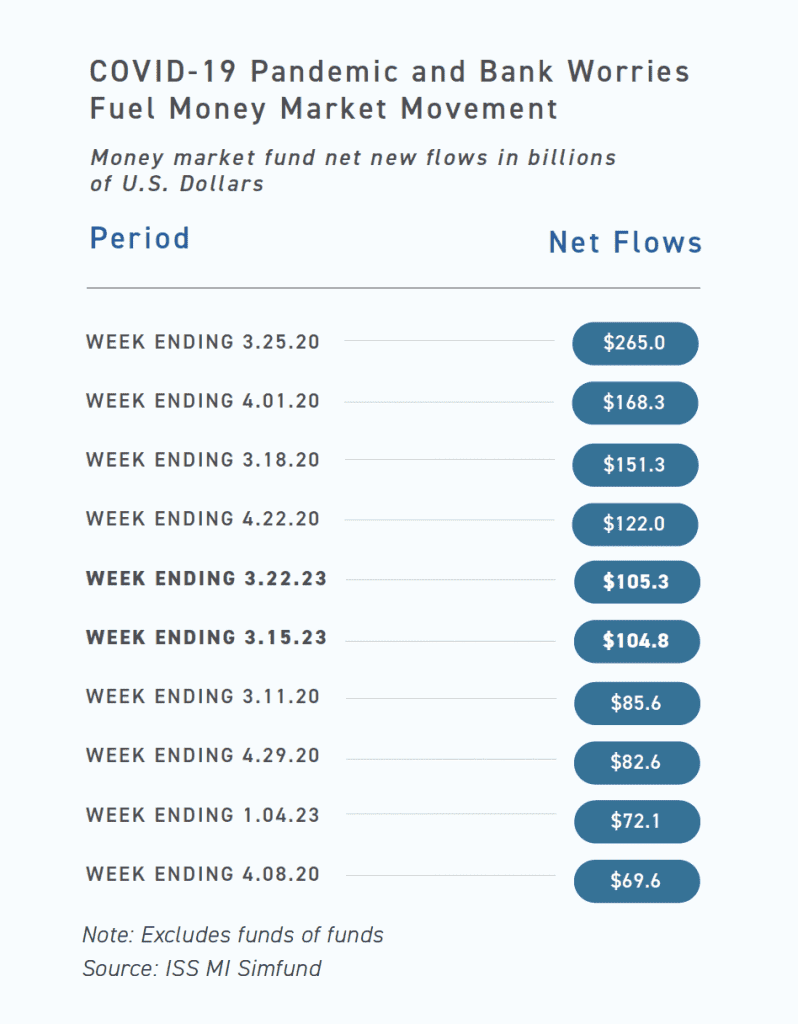

The collapse of Silicon Valley Bank (SVB) on March 10th drove investors to money market funds to a degree not seen since the COVID-19 pandemic. Weekly data from ISS MI Simfund highlights the whipsaws in demand seen across long-term and short-term funds across March 2023.

Money market funds often record significant swings in flows on a monthly basis as investors withdraw money to place in longer-term securities or retreat to safety during volatile markets. The scale of activity seen in March however placed that period within the highest weeks recorded over the past decade. As seen in the table below, worries about the knock-on effects to the rest of the financial system have not been this strong since the onset of the pandemic three years beforehand.

In the immediate lead up to and wake of the SVB collapse, investors broadly demonstrated a risk-off approach, with substantial outflows across major asset classes. U.S. equity funds faced net outflows to the tune of $14.3 billion. The ease of trading ETFs allowed them to bear the greatest brunt of this tactical rotation as they saw net redemptions of $10.3 billion. The drastic movements in financial-related stocks still prompted contrarian buying opportunities.

Financial sector flows overall during the week ending March 15th were moderate at $332 million but demonstrated a sharp divide. Investors flocked to the SPDR S&P Regional Banking ETF, which had higher exposure to both Silicon Valley Bank and Signature Bank, which was also placed in federal receivership. The $1.4 billion that the fund garnered over that week accounted for an astonishing 62.3% of assets seen just the week prior. This was a wide lead over the $110 million gathered by the next highest financial fund, the iShares US Regional Banks ETF, which focused on a similar subset of banks. Over that same period, investors withdrew $723 million from the much larger, and more widely targeted, Financial Select Sector SPDR ($32.6 billion as of March 8th).

Surveys performed by ISS Market Metrics between March 13th and 28th found that 23% of polled advisors had repositioned client portfolios in response to recent bank failures. While a number of advisors cited shifting towards regional bank stocks, they much more frequently cited the conservative steps they took, such as reallocating into money markets and federally-insured products.

Fears of contagion continued to sustain money market flows through the week of March 22nd, but that period also represented one of rebounding demand for long-term funds. Large-cap equities, primarily in the form of passive ETFs, represented both the greatest source of outflows over the week leading up to March 15th (net redemptions of $10.5 billion) as well as the largest source of inflows the following week (net deposits of $13.5 billion). Regulators and other financial institutions took extraordinary measures in the wake of the bank run, from federal regulators offering to guarantee all deposits at SVB to a consortium of other banks offering to deposit $30 billion with First Republic Bank to stem the pressure on other deposit-taking institutions. While such actions have helped reverse the immediate outflows faced by long-term funds, money market flows could remain elevated as the situation unfolds further.

By: Alan Hess, Vice President, U.S. Fund Research, ISS Market Intelligence