In this latest UK financial adviser fund sales highlights, Benjamin Reed-Hurwitz, EMEA Research Leader at ISS MI, focuses on the latest net and gross sales trends for Q2 2023, gathered directly from platforms and asset managers. Benjamin details fund sector performance, and considers changes taking place within the UK investment landscape.

Q2 2023 Fast Facts

The below data is based on on-platform financial adviser sales through ISAs, Personal Pensions, Direct Investment Accounts and Investment Bonds for Q2 2023.

Totals

| Gross Sales: £29.8 billion | |

| Net Sales: £100 million |

Wrappers

| GIA Net Sales: -£700 million | |

| Pension: £530 million | |

| ISA: £170 million | |

| Bond: £100 million |

Firms

| Number of firms with £1 million in net sales or more: 809 |

| Active Net Sales: -£1.1 billion | |

| Passive Net Sales: £1.2 billion |

Ten Best Selling IA Sectors by Net Sales

| Unclassified | North America |

| UK Gilts | Global Emerging Markets |

| Global | Short Term Money Market |

| Global Mixed Bond | USD Government Bond |

| Volatility Managed | Sterling High Yield |

Three Best Selling Fund Managers by Net Sales

- BlackRock

- HSBC Asset Management

- Dimensional Fund Advisors

Talk to us today to learn more about how ISS Market Intelligence can help your business.

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader ISS Market Intelligence

SHARE THIS

ISS Market Intelligence Projects U.S. AUM to Hit $43.6 trillion by 2029 Amid Surge in Active Strategies and Liquid Alternatives

Our research underscores a pivotal transformation in the investment landscape. The convergence of increased market complexity and investor sophistication is

Have we hit the peak of the model portfolio adoption curve?

The model portfolio sector in the U.K. is at a crossroads. Following a sales boom in 2023, model portfolio (MPS)

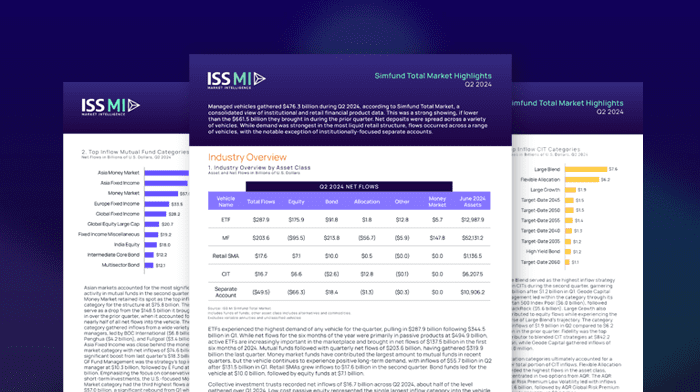

Simfund Total Market Highlights Q2 2024

Managed vehicles gathered $476.3 billion during Q2 2024, according to Simfund Total Market, a consolidated view of institutional and retail