In this still-young decade, fund managers have been roiled by outside forces: a global pandemic, political and social turmoil, high inflation, and the fastest increase in interest rates in decades. While the two bear markets in the period were relatively short, they helped hasten investors’ shift away from mutual funds and to ETFs and non-1940 Act vehicles like separately managed accounts (SMAs). The benefits of surging organic growth in 2021, fueled by a one-time build-up in savings related to COVID-era stimulus and depressed spending, were shared widely, but they did not last for long. The Fed’s aggressive rate hikes squashed demand for long-term assets and triggered record-breaking outflows from actively managed strategies, including—unlike most downturns in recent memory—from active bond funds.

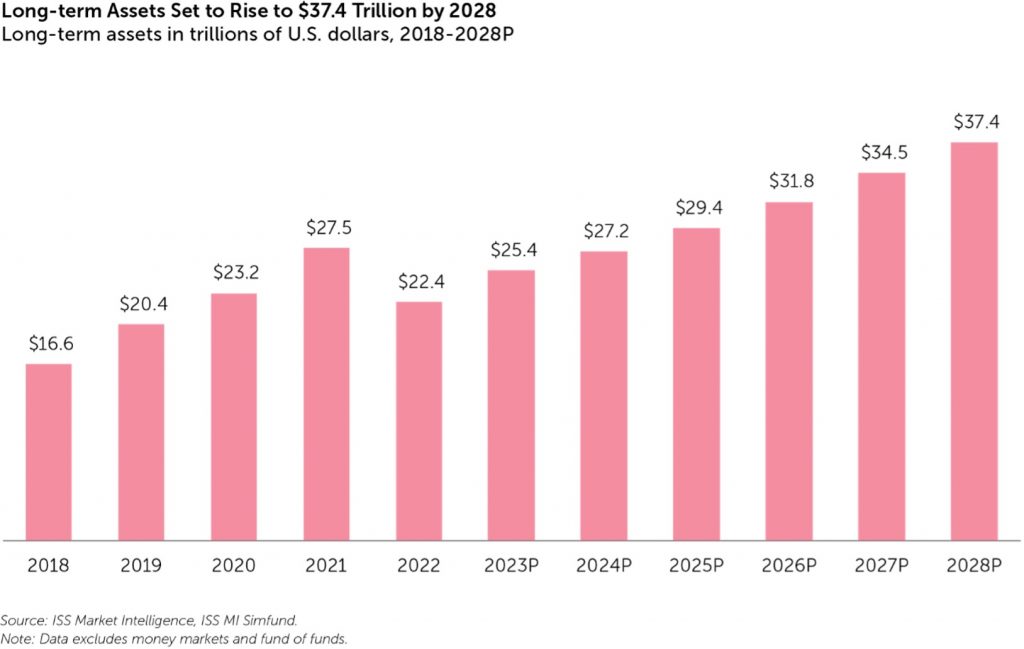

For all the turmoil managers have faced in recent years, opportunities to benefit from growth in assets under management (AUM) were surprisingly good. ISS MI estimates that long-term assets will finish 2023 having risen 8.9% annually over the prior five years, on par with the average this century. By our estimate, long-term fund AUM will have grown from $16.6 trillion to $25.6 trillion over the period, an increase of $4.3 trillion.

Managers who can adapt to the challenges of the next half decade will have a crack at a much larger pie: ISS MI’s 2024-2028 outlook, detailed in the recently published State of the Market: Future of Retail Products 2023 report, pegs 2028 AUM at $37.4 trillion. The $12 trillion rise in AUM, depicted below, translates into an 8.1% average growth rate, lagging the prior five-year period only slightly.

While our outlook incorporates more modest expectations for market appreciation, fund managers with strong sales and distribution capabilities will benefit from rebounding organic growth, or growth in net flows. As organic growth reverts from depressed levels to historical trend, ISS MI anticipates long-term funds will rake in $2.7 trillion in net new sales from 2024-2028. As a percentage of beginning period AUM, we expect flows to grow at a 2.1% annualized pace over five years, beating the estimated 1.5% for growth rate for the previous half decade.

Asset class outlook: Bonds funds regain market share, equities slip

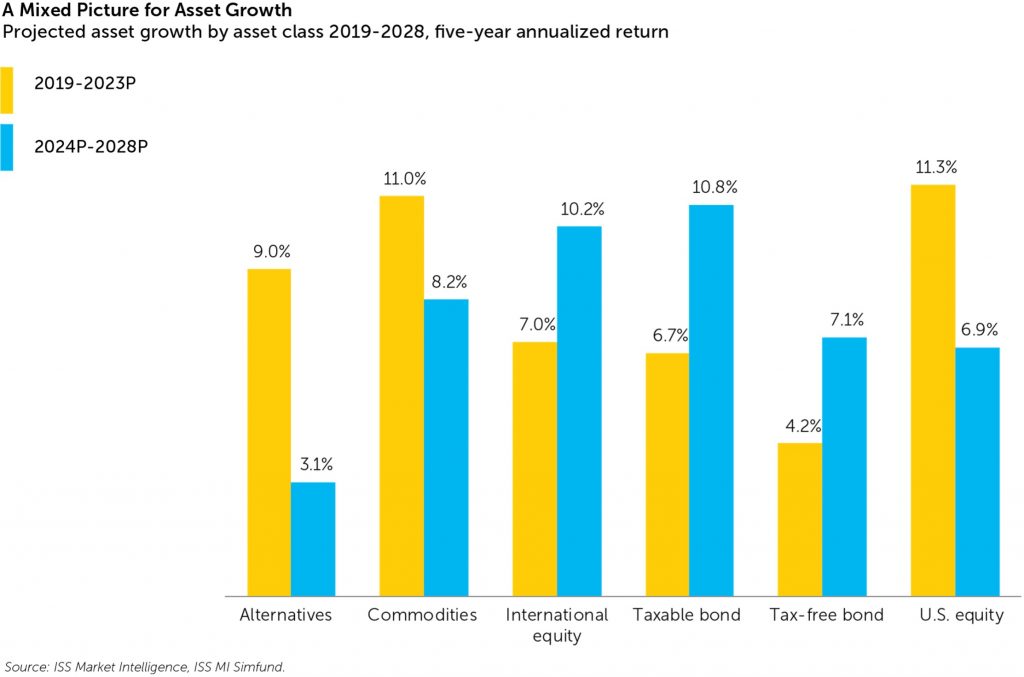

Do not expect AUM to rise evenly across asset classes, however. The chart below, which summarizes our broad asset class outlook, shows bond funds outgrowing their equity fund counterparts over the next five years.

Fund managers should anticipate much slower growth from stock funds in the coming half-decade, especially those invested in U.S. stocks. Despite outflows in seven of the past 10 calendar years, the asset class has outperformed to such a degree that fund investors’ U.S. equity weighting sits at levels last seen in the mid-2000s, when allocators systematically shifted towards heavier international weightings to combat home country bias. With fund investors under-invested overseas, asset allocators are likely to rebalance portfolios away from U.S. stocks, driving sales of international equity funds modestly higher.

By historical standards, fund investors are more heavily underexposed to fixed income, making bond funds likely an even larger flows beneficiary from portfolio rebalancing. The shock of high inflation and fast-rising interest rates will likely dampen near-term interest, but higher yields, along with more a more stable rate and inflation environment should bring bond investors back to the field. Higher yields also make stocks less attractive because they make it possible for investors to meet their return targets by holding more lower-risk bonds and cash. The need for income will also grow more acute thanks to demographics: By 2030, the U.S. Census Bureau estimates the number of Americans in retirement age will have grown by 17.1 million over the prior decade, raising the over-65 share of the population from 17% to 21%.

Our modest expectations for commodities and alternatives stem partly from our model’s bearish near-term forecast for the asset classes. Compared with prior year forecasts, alternatives’ asset growth outlook has weakened amid surprisingly sharp outflows from many hedge fund-like categories and proliferating non-’40 Act structures like interval funds attracting interest. While the traditional fund format will remain well suited for leveraged and hedged trading strategies, broadened access to private market alts will chill retail fund sales. High volatility and vulnerability to unpredictable shocks create uncertainty around our forecast for commodities, but as a fixture in many asset allocation programs, the asset class benefits from a base of steady demand, albeit primarily from index investors.

Expect the unexpected

General Dwight Eisenhower once called war plans useless but described planning as indispensable. Plans, like forecasts, almost certainly will not play out as expected. In a complex system where the economy, regulation, investor behavior, and market dynamics interact, the future for asset managers is bound to bring surprises we cannot anticipate. What we can do, however, is understand the underlying forces driving today’s realities and make reasonable assumptions about market performance and investors’ asset class preferences to sketch out a plausible future. As always, managers will need to be resilient enough to weather the unexpected, but those that plan to match their capabilities to the many possible opportunities can thrive.

_______________

Simfund Enterprise subscribers can access the State of the Market: Future of Retail Products 2023 report on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head, U.S. Fund Research