In a complex and competitive market, alternative investments continue to gain traction as a tool for hedging against the traditional 60/40 portfolio. Through a wide range of investment types, alternatives claim to provide a hedge when traditional approaches fail to produce yield. Are these investments actually increasing in assets under management? How can asset managers stay informed about benchmarks and predicted flows in this space?, Flowspring, our predictive analytics tool for asset flows, can serve as an integral part in answering these questions, leading to faster and more accurate decision-making.

Liquid Alternative – A Deeper Dive

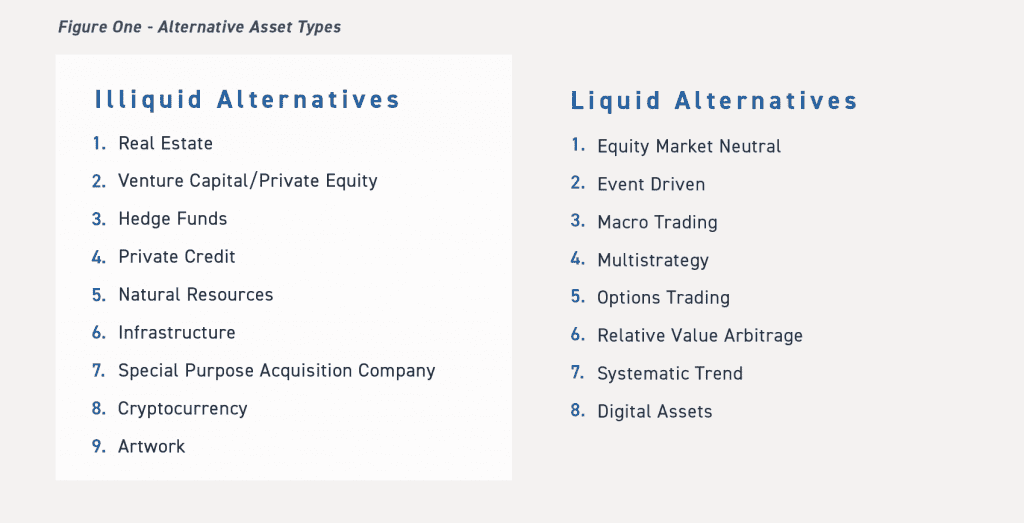

Liquid Alternatives are characterized by their ability to take both long and short positions, remain unconstrained by traditional benchmarks and generate an absolute return. Many of these assets employ proprietary hedge fund strategies to reach their fund objectives. These products are typically sold to investors in a mutual fund or ETF.

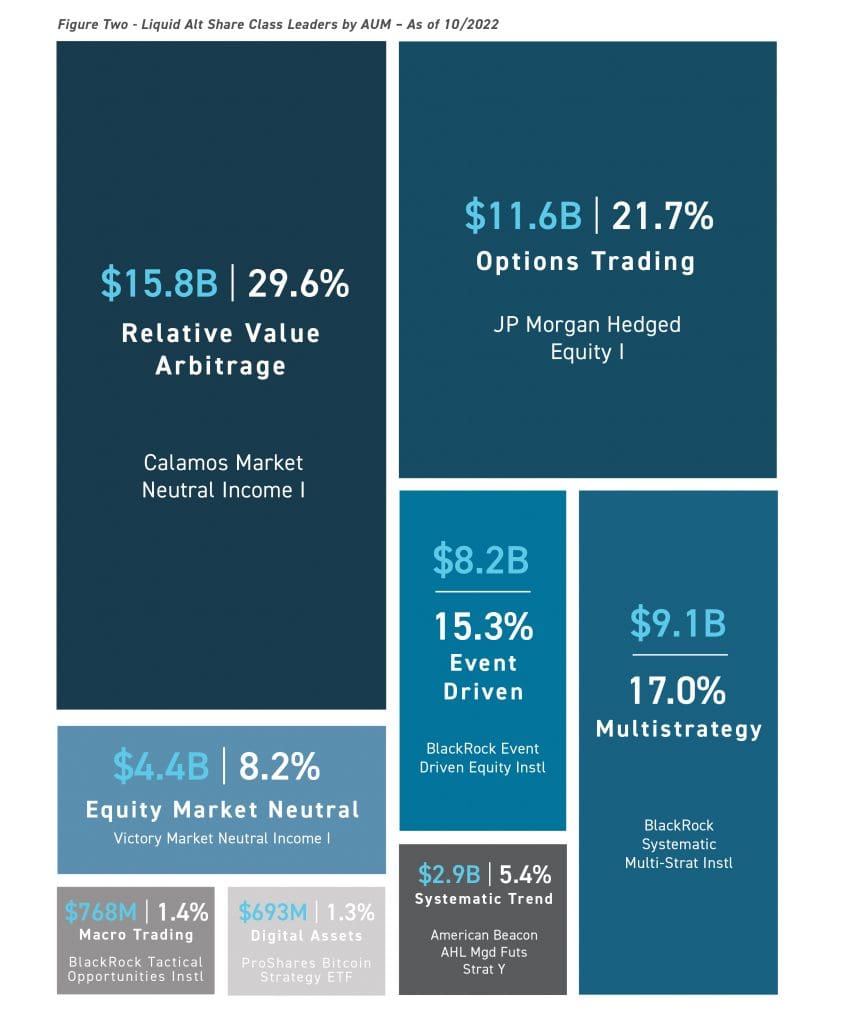

While Liquid Alts are still a relatively small part of the overall mutual fund and ETF market, we do see flow growth trending positive. All liquid alt categories we track saw a net positive inflow over the past 12 months (note: data as of Oct. 2022 and Is illustrative). The current share class leaders for each category collectively manage $53.4B in AUM. Their relative percentage of holdings can be seen in the table below.

Where Are We Headed?

Flowspring, uses a proprietary machine learning model that has a proven ability to accurately predict directionality of asset flows. Flowspring’s predictive analytics leverage a decision tree algorithm which captures non-linear relationships between fund flows and 40+ factors that drive fund flows. These factors reflect investor preferences and are derived from a rich dataset and incorporate various dimensions of funds, including performance, brand, distribution, and many product characteristics including category, fees, and asset allocations.

Across the board, we are predicting an increase in inflows to continue for all liquid alternative categories. Our model is predicting modest growth for most categories over the next 12 months compared to the trailing 13 years of flows. However, we do see that Systematic Trend and Macro Trading will be the fasting growing product types from an inflow perspective (note: data as of October 2022).

While our model looks at multiple factors when assessing net flow predictions, we can infer that in the current macro environment Systematic Trend may be attractive because of its stated objectives of having low correlation to other asset classes and its ability to profit in both rising and falling markets.

Through its predictive modeling capabilities, Flowspring provides asset managers focused on strategic product and pricing decisions the ability to examine historical fund performance and, more importantly, understand where fund flows and fund fees are headed. In complex and competitive markets, this information should be an integral part of any asset manager’s toolbox when determining their product strategy, leading to greater agility, speed-to-market and improved decision making.

Learn more about asset flows and fee compression/expansion for liquid alts by signing up for a free trial of Flowspring. Please note: the data and forecasts run within this article were conducted as of October 2022 and are illustrative of the forward-looking predictive capabilities of Flowspring. The forecast results may change at different points in time and can be further explored by contacting us directly here or at sales@Issmarketintelligence.com.

To read the full article, go to Flowspring Research or to Flowspring.com to learn more about how Flowspring’s proprietary predictive modeling framework provides actionable insights to support critical strategic planning and decision making for product development and rationalization, competitive benchmarking, pricing and fee analysis and more.

By: Saleem Khan, Executive Director, ISS Market Intelligence