Mutual fund and ETF providers have lived in different sales universes over the past couple years. After record-breaking flows boosted both vehicles in 2021, sales of mutual funds—especially active ones–fell through the floor in 2022 and through year-to-date September 2023 while ETFs enjoyed strong inflows. Since the start of last year, ETFs netted $835 billion in sales as long-term mutual funds shed $1.2 trillion.

Active mutual funds bore the brunt of the outflows, capping a half-decade of dramatic market share losses. The vehicle’s share of long-term assets under management (AUM) stood at 49% at the end of the third quarter, down sharply from 61% at the beginning of 2019.

This sharp decline, driven mainly by migration to index ETFs, will leave a lasting mark on active fund managers. That is because the decision to switch from active mutual funds to passive ETFs is usually a strategic one that is not quickly, if ever, reversed. Active ETFs will help some managers make up lost ground, but under no plausible scenario will they do so entirely. With 2022’s volatility setting into motion structural change, most managers will grow their active businesses from a shrunken base.

Active mutual fund managers will continue to face ongoing market share losses over the next five years, albeit at a much slower pace. ISS MI’s 2024-2028 outlook, detailed in the recently published State of the Market: Future of Retail Products 2023 report, forecasts active mutual fund market share falling another seven percentage points, finishing the five-year period with 42% share.

Although active management’s sales prospects may be structurally weaker, they are also unduly depressed by cyclical factors. The confluence of lousy market conditions, surprisingly high inflation, and the fastest rise in interest rates since the early 1980s put active mutual fund sales under extreme duress. The stress was magnified by the unusual (by recent historical standards) simultaneous decline in stocks and bonds, which left few places for investors to hide.

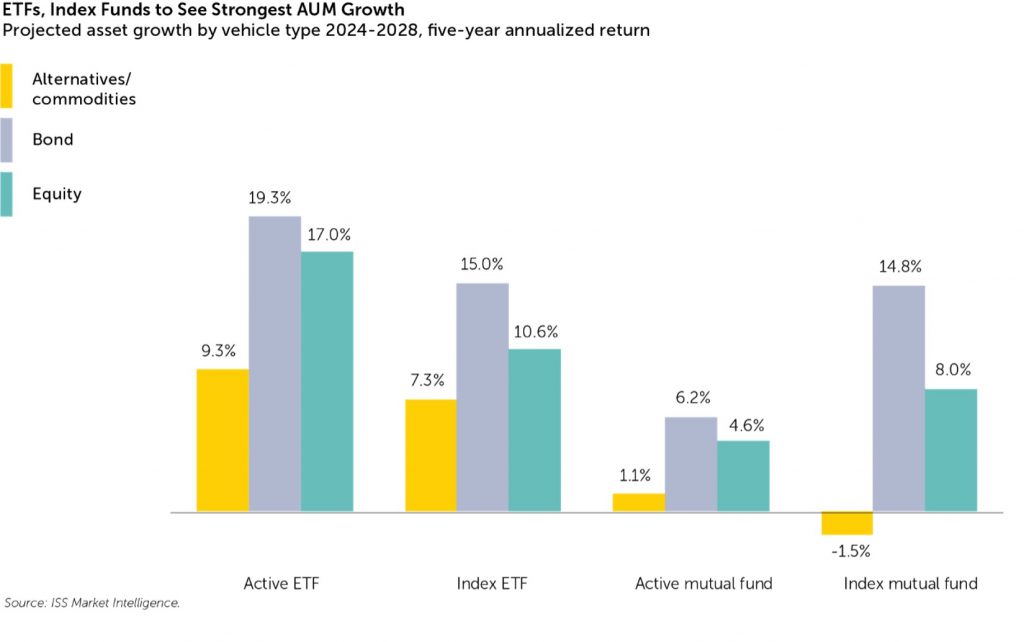

As these conditions abate, fund investors should regain their appetites, albeit slowly. The chart above shows our five-year AUM growth expectations for active mutual funds as still modest. It also depicts ETFs as a promising growth driver for active managers, though a limited one. We estimate active ETFs will represent just 2.7% of long-term AUM by 2028—almost a percentage point above current levels but nowhere near enough to make up ground lost in recent years.

Active bond fund managers should see a more favorable sales backdrop. While fixed income ETFs’ recent market share gains will translate into a growing share of fixed income fund sales, funds will benefit from demographics-driven demand for fixed income exposure over the long term. A less hostile interest rate environment will likely lead to a delayed recovery in flows, stemming active mutual fund redemptions and eventually reigniting sales.

The sales gains bond funds reap from an aging population mainly come at stock funds’ expense. Active equity strategies are at the front lines of the demographic transition because their shareholder bases are older on average, and widespread antipathy to active management makes replenishing lost assets a tall order.

Keeping it in Perspective

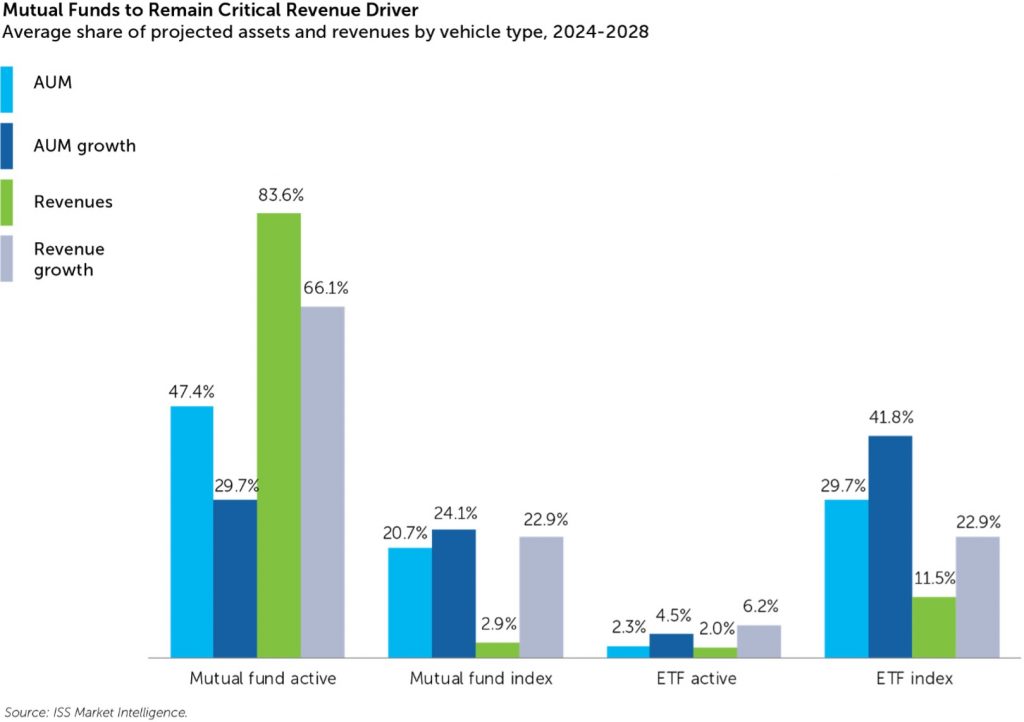

In most industries, market share losses of a similar speed and magnitude as active funds’ would be catastrophic. It certainly has not been a picnic for active managers in recent years, but the impact on what really matters—revenues from management fees—has been surprisingly modest. Even with active fund market share flirting with sub-50% levels, we estimate they still produced 87% of the revenues generated by long-term funds last year.

The chart above still shows active funds remaining as the industry’s revenue engine in the coming years, albeit one with diminishing horsepower. With index funds poised to deliver outsized asset growth over the next five years, we project active funds’ share of revenues will fall to the mid-80s (averaging 84%) over the next five years.

Of course, diminishing market share, even if less drastic measured in revenue terms, is hardly a positive for active managers. A shrinking revenue pool inherently creates zero-sum dynamics where one manager’s gains represent another’s losses. Some players inevitably will be left high and dry.

Zoom out, however, and one can see new, potentially lucrative sources of revenues emerging. ETFs offer opportunities for active managers to win share from rival fund managers. The rising popularity of separately managed accounts (SMAs) provides another avenue for active managers to sell their wares. Growing adoption of less-liquid strategies by retail investors, either through structures like interval funds or private market platforms like iCapital, afford managers additional means to market their alternatives capabilities. With a future that looks much different than the past, expect new winners to emerge.

_______________

Simfund Enterprise subscribers can access the State of the Market: Future of Retail Products 2023 report on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head, U.S. Fund Research