NEW YORK (July 9, 2024) – ISS Market Intelligence (ISS MI), a leading global provider of data, analytics, insights, media, and events to the global financial services industry announces the release of its latest Global Whitepaper: Growing Revenues, Not Assets, New Name of the Game.

The whitepaper, which studies revenue growth trends across mutual funds and ETFs in the U.S., U.K., and the main European cross-border markets, shows revenues under strain on both sides of the Atlantic. It also discusses how asset managers can confront the double threat that the rapid growth of index funds and falling management fees poses to their top lines.

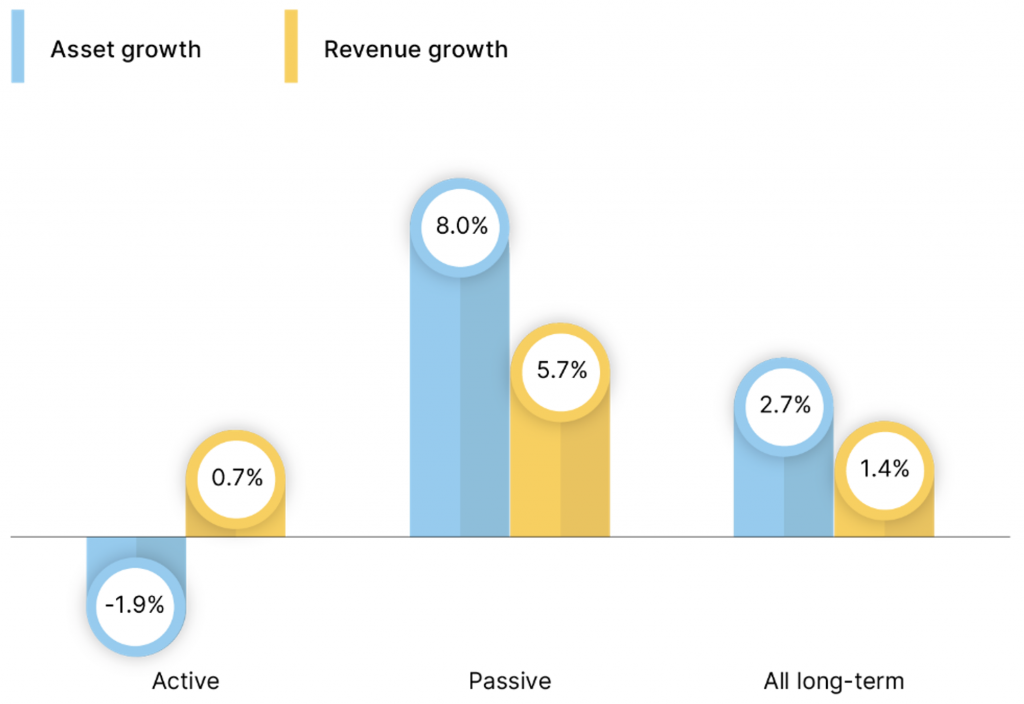

In 2023, estimated revenues from long-term funds barely grew in the U.S., and shrunk in the U.K. and the main European cross-border markets. Index funds’ growing market share, aided by the proliferation of ETFs, coupled with weak growth of their books of business, left fund managers struggling to grow their revenues. In the U.S., ISS MI estimates revenues generated by long-term active funds fell 1.9% as revenues from index funds rose 5.7% (see chart below).

Active Fund Revenues Under Pressure

Estimated growth in long-term fund revenues and average assets under management, 2023

Note: Data exclude money market and fund of funds.

Despite index funds’ large market share gains in assets under management (AUM), the paper confirms active management as the industry’s primary revenue engine. Even with AUM market share falling below 50% for the first time in the U.S. in 2023, the analysis shows active funds generating an estimated 86% of the revenues generated by long-term funds in 2023.

Goshka Folda, Managing Director and Global Head of Research at ISS MI explains that “while a large, if shrinking, active fund market will continue to support the industry’s revenue base, asset managers will need to find new avenues to grow their top lines. The white paper identifies several strategies for potential success, including expansion into categories such as alternatives, ETFs, and model portfolios.”

To return to expansionary paths, asset managers will have to refit their product and distribution strategies for the new normal of slower organic fund inflows, intense competition, and changing distribution paradigms. Folda continued, “Focus and agility will be essential weapons in the fight to stand out from the crowd and to quickly adapt to shifts in the needs and preferences of distributors, advisors and investors. The trick will be to do all this while the economics of the business—while still very healthy—are slowly eroding.”

The full report is available now in the newly launched MarketSage research platform, a key addition to ISS MI’s suite of solutions designed to provide unparalleled access to surveys, insights, and unbiased research that empowers financial services professionals to make informed decisions and stay ahead of market trends.

“The Global Revenues Whitepaper is just one example of the wide array of research available in our new research platform, MarketSage,” adds Folda. “Our consolidated hub makes it easy for our clients to stay well-informed in today’s fast-moving world through simplified access to the best research, insights, and thought leadership in the industry.”

To explore the MarketSage platform, please visit https://marketsage.issmarketintelligence.com/.

For additional information on ISS Market Intelligence and its suite of solutions, visit https://www.issmarketintelligence.com/.

###

About ISS Market Intelligence

ISS Market Intelligence (MI) is a leading provider of data, insights, and market engagement solutions to the global financial services industry. ISS MI empowers asset and wealth management firms, insurance companies, distributors, service providers, and technology firms to assess their target markets, identify and analyze the best opportunities within those markets, and execute on comprehensive go-to-market initiatives to grow their business. Clients benefit from our increasingly connected global platform that leverages a combination of proprietary data, powerful analytics, timely and relevant insights, in-depth research, as well as an extensive suite of industry-leading media brands that deliver unmatched market connectivity through news and editorial content, events, training, ratings, and awards.

About ISS STOXX

ISS STOXX GmbH, through its group companies, is a leading provider of comprehensive and data-centric research and technology solutions that help capital market participants identify investment opportunities, detect qualitative and quantitative portfolio company risks, and meet evolving regulatory requirements. With roots dating back to 1985, we today deliver world-class benchmark and custom indices across asset classes and geographies and serve as a premier source of independent corporate governance, sustainability, cyber risk, and fund intelligence research, data, and related offerings. Our products and services give clients the scale and leverage they need to grow their business more effectively and efficiently. ISS STOXX, which is majority owned by Deutsche Börse Group, is comprised of more than 3,400 professionals operating across 33 global locations in 19 countries. Its approximately 6,400 clients include many of the world’s leading institutional investors who turn to ISS STOXX for its objective and varied offerings, as well as companies focused on ESG, cyber, and governance risk mitigation as a shareholder value enhancing measure. Clients rely on ISS STOXX’s expertise to help them make informed decisions to benefit their stakeholders.

Media Contact:

Morgan Stoll

Analyst, Marketing

press@issmarketintelligence.com