As the fortunes of the traditional mutual fund have faded, active managers have looked to ETFs as tomorrow’s growth engine. They are not wrong to do so: Over the next five years, active ETFs enjoy stronger growth prospects than any other vehicle type.

ISS MI’s 2024-2028 outlook, detailed in the recently published State of the Market: Future of Retail Products 2023 report, anticipates active ETF assets growing at a 17% annualized pace, well ahead of a forecasted 12% for index ETFs and a 6% rate for all long-term funds.

Active ETFs will also earn an outsized slice of the industry’s total revenue growth. Even with relatively modest market share gains—from an estimated 1.7% at year end to 2.4% in 2028—we anticipate that active ETFs will absorb 6.4% of the revenue growth generated by long-term funds over the next five years. That is not enough to overcome index ETFs’ expected gains, but as growth drivers, active ETFs should punch above their weight.

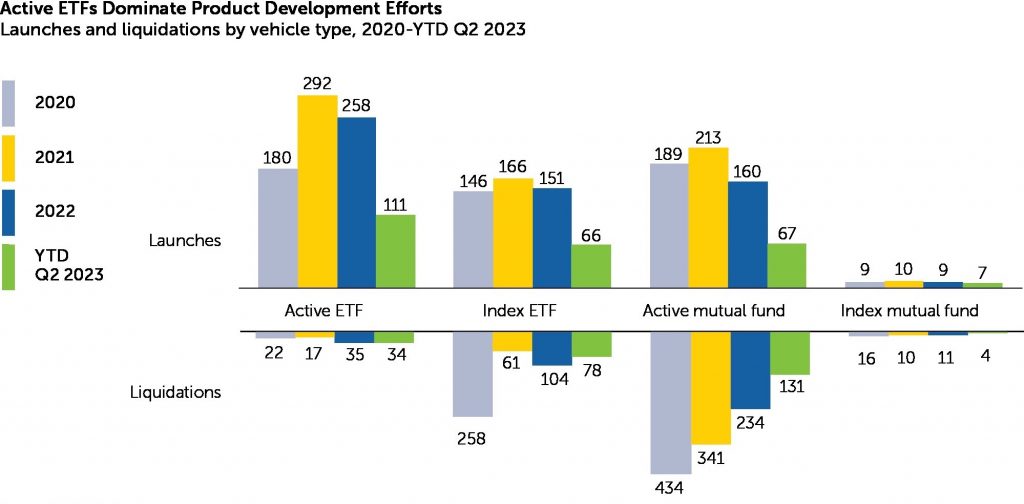

This is the future that product developers have anticipated. Active ETFs have led product developers’ efforts for years now, with the table below showing more net new launches than other product types since 2020. Meanwhile, the active mutual fund universe has been shrinking. And while index ETFs remain a vibrant area of product development, it is a mature one where dozens, if not hundreds, of existing products close their doors every year.

Bad Odds or Bad Bet?

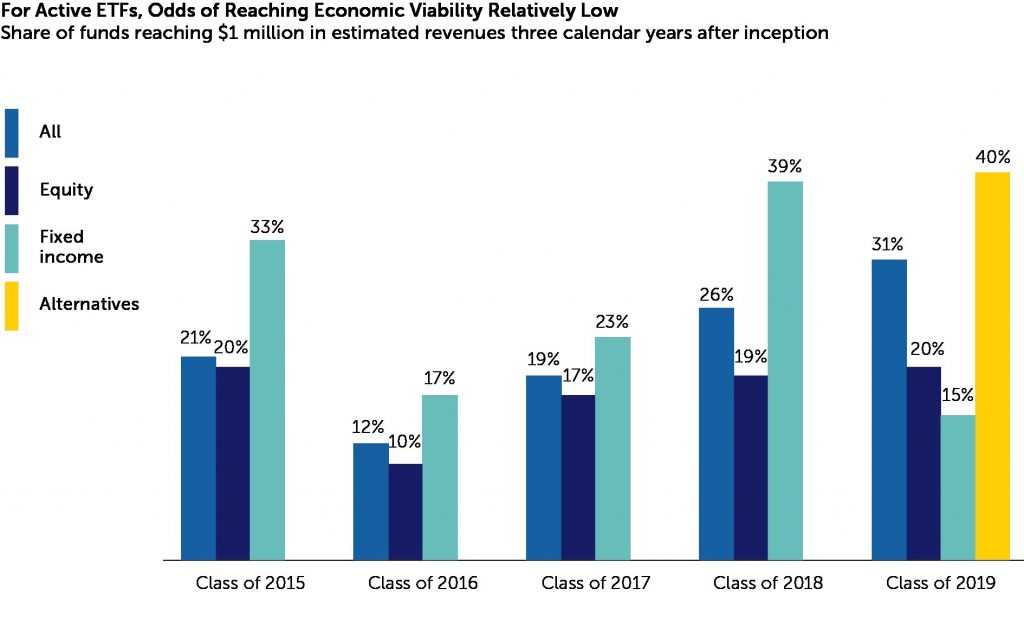

While active managers have been right to focus on ETFs, most have seen disappointing results for their efforts. Historically, the odds of reaching sufficient scale to generate meaningful revenues have been slim.

To assess the likelihood of economic viability, we measured the rate at which active ETFs generated at least $1 million in annual revenues within three years of launch beginning in 2016. As the chart below illustrates, the odds of reaching this threshold were not favorable overall, albeit they were usually worse in equities than they were in bonds; the 2019 vintage was most successful for alternatives, with earlier years’ samples too small to judge. More often than not, launching new funds is—as Oscar Wilde described second marriages—a triumph of hope over experience.

Given the odds of disappointment, is new product development an exercise in imagination more than intelligence? Certainly, there is no innovation without imagination, and bringing something new to market invariably requires a leap of faith that no amount of logical analysis can completely justify. That is not the same thing as saying that it is irrational, however.

In fact, rational players enter low-probability games all the time. There are no bad odds, professional gamblers will tell you, only bad bets. Statistics 101 tells us that good decision-making weighs the odds of success against the potential payoff of action. If the possible payoff is high enough—or in statistics-speak, the expected value is sufficiently positive—betting on a low probability outcome makes logical sense.

By this metric, the deluge of new active ETFs is a rational response to economic reality. While most will never generate meaningful revenues, the winners typically garner an outsized share of the total winnings generated from new product development. About 70% of active ETFs that debuted in 2019 failed to reach the $1 million-plus mark in annual revenues by 2022, for example, but those that did captured 85% of the estimated revenue from the year’s new funds.

To the Victor Go the Spoils

These winner-take-most dynamics are likely to persist. One reason why: Shrinking shelf space at many distributors. Gatekeepers increasingly decide which funds get sold and are typically averse to blessing products without track records when so many other options exist. Few make the cut, leaving a relatively small cohort to absorb growing demand. Additionally, ETF buyers disproportionately favor first-movers in nascent product categories, limiting latecomers’ ability to win market share.

Certainly, these funds’ scale advantages can be self-perpetuating. Popularity breeds trading volume, leading to more visibility–and even more important–reduced bid/ask spreads, both of which should be a boon for sales. As liquidity ls especially important to larger-scale ETF investors, high trading volumes open the door to larger-scale sales.

Additionally, as active ETFs are relatively early in their product cycles, providing greater opportunities for already successful firms to differentiate themselves and compete where they are strongest. Active equity ETFs, at least those not employing quantitative, factor-based approaches, are relatively new in the United States, so brand power—and the trust that comes with it—are especially important. These traits are relatively scarce, and so there are only a few big winners in a new product category.

There is no magic formula available to determine which new products are worth launching and which ones are not. Whether the potential rewards are worthwhile hinges on the organization’s investment and distribution capabilities, scale (smaller payoffs are more meaningful for smaller firms than for larger ones), and their broader objectives. A bet that has high expected value but which is inconsistent with a manager’s investment philosophy probably is not worth making because of the long-term damage it might do its brand. A decision with a lower expected value might still be worth doing because of the brand value it creates. In isolation, one bet might be worthwhile, but business leaders must ask themselves whether it is worthwhile relative to other bets they could be making. As with many complex situations, the right strategic approach to the active ETF question is “it depends.”

______________

Simfund Enterprise subscribers can access the State of the Market: Future of Retail Products 2023 report on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head, U.S. Fund Research