Resources

Insights, thought leadership, case studies, and more

Whose Portfolio is it, Anyway? Tailoring Your Fund Distribution Approach to Fund Selector Demands

Now more than ever, knowing the portfolio constructor behind clients’ portfolios is essential to winning in the UK fund market.

The Future of Asset Management: ETFs, Alts, and Private Markets Reshape the Retail Landscape

While interest in active ETFs will likely not grow anywhere quickly enough to make up for the losses from active

ISS Market Intelligence Projects U.S. AUM to Hit $43.6 trillion by 2029 Amid Surge in Active Strategies and Liquid Alternatives

Our research underscores a pivotal transformation in the investment landscape. The convergence of increased market complexity and investor sophistication is

Have we hit the peak of the model portfolio adoption curve?

The model portfolio sector in the U.K. is at a crossroads. Following a sales boom in 2023, model portfolio (MPS)

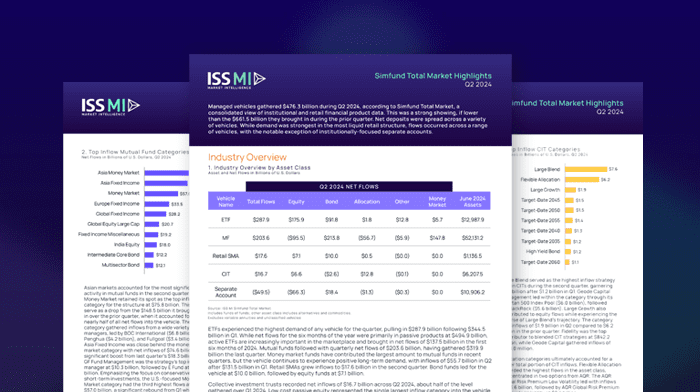

Simfund Total Market Highlights Q2 2024

Managed vehicles gathered $476.3 billion during Q2 2024, according to Simfund Total Market, a consolidated view of institutional and retail

Pridham Report: Q3 disappoints after strong ISA season

As the wealth market in the UK has consolidated, it is more common to see partnerships between fund groups and

Multi-Asset Fund Sales Turn Positive for the First Time in Five Quarters

Net sales of multi-asset funds, in the U.K. turned positive for the first time in five quarters in Q2 reaching

New Research Highlights the Crucial Role that Digital Content Plays in Financial Advisor Decision Making

Thought leadership content is a critical way for asset managers to promote their investment philosophy, display how their products respond

ISS MI’s Advisor Pulse Research Reveals Digital Content’s Role in Investment Decision Making

The Advisor Pulse Series – Digital Content report is based on the results of over 600 interviews with U.S.-based financial